To start or resume your application or to add services to your account please enter your credentials below. Fill In Our Quick And Easy Form To See How Much Tax Free Cash You Could Release.

For example say your house appraises for 200000 and you have 120000 left to pay on your primary mortgage.

. At PSECU we offer both fixed and adjustable rate conventional mortgages with an interest rate determined by term length and any points purchased. Ad Get a Secured Loan For Home Improvements Or To Consolidate Your Debts. If youre ready to start the refinancing process PSECU can help.

To determine your equity your lender will subtract how much. Available for youth under 13 years of age. Put Your Equity To Work.

Fixed And Variable Rates Available. Your remaining home equity would be 80000. Real Estate Equity Loans have a minimum loan amount of 5000.

Existing PSECU equities may be refinanced for additional funds of 5000 or more. Home equity is the difference between the appraised value of your home and how much you still owe on your mortgage and any other property liens. Oftentimes the interest rate on a HELOC is much lower than the interest rates on your existing debts especially credit cards.

Fill In Our Quick And Easy Form To See How Much Tax Free Cash You Could Release. Must be permanently employed and have equity in your home. Although your lender will make the final calculations you should have a basic understanding of how this figure is derived.

A financial institution assesses the value of your home. No Impact On Credit Score. Borrow up to 90 of the appraised value less any liens on the property being mortgaged.

To learn more about how to refinance a home and. Borrow against your homes value with our home equity loan products including Real Estate Equity Loans and Home Equity Lines of Credit HELOC. Release Equity From Your Home As A Cash Lump Sum Or Regular Payments You Decide.

A Custodial account is a great way to help the child in your life get a head start on savings. 25000 loan for 60 months at 324 APR will have a monthly payment of 45189. We offer a variety of mortgages for current homeowners and are happy to assist you in choosing the loan thats best for you.

The first step in the process of obtaining a home equity loan is to ensure you qualify for a loan. Skip to the main content. With a Real Estate Equity Loan from PSECU you can.

You need to figure out how much equity you have in your home. Ad Age 55 And Looking To Free Up Cash From Your Home. We are a not-for-profit credit union providing a full array of convenient electronically delivered services at no or low cost.

Ad Take Control Of Your Finances With A Secured Loan. Lifetime Mortgage Could Be An Option. For those 13 years of age and older a General Membership account provides access to free checking with no.

Real Estate Equity Loans - PSECU Refinancing. Minimum loan amount 10000. Existing PSECU equities may be refinanced for additional funds of 5000 or more.

One of the most practical reasons to use a home equity line of credit is to consolidate debt. Rates are as low as 450 APR as a floor and a maximum APR of 1800. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Ad Age 55 And Looking To Free Up Cash From Your Home. We offer competitive low rates no appraisal or application fees an easy application process and flexible terms for property owners in Pennsylvania. Dont Wait For A Stimulus From Congress Refi Before Rates Rise.

Selina Advance Offers Secured Loans That Give You Flexible Funding - Terms Apply. Conventional loans are the most common type of mortgage since they have the most flexibility and often offer the lowest interest rates. Custodians dont need to be members but the child must be eligible to join.

You can use a home equity loan to borrow. Home equity loans PSECU calls these real estate loans are generally disbursed in one lump sum. Try Our Free Eligibility Checker Now.

Say that value is 200000. If You Have a Mortgage on Your Home and Need a Loan From 10k - 1 million We Can Help. If you borrow 20000 for example you 6.

Up to 60 of 5. With a Real Estate Equity Loan from PSECU you can. A home equity loan allows you to borrow money using the equity youve built up in your home.

If you have a home equity loan or line of credit you might be able to refinance your loan to take advantage of a better interest rate. Lifetime Mortgage Could Be An Option. You subtract the amount of money you still owe on your mortgage from the value of the home.

If you feel overwhelmed by your debt or your monthly payments are too high consider opening a home. Were the credit union of choice for hundreds of. We serve more than 400000 members and have over 4 billion in assets.

Lets look at an example of how equity is determined. PSECU offers home equity loans fixed-rate closed-end for members who want to use unimproved land as the collateral for the loan. A home equity line of credit is a variable rate loan that may adjust monthly.

APR may be adjusted based on individual credit standing and term. In fact were proud to be one of the largest credit unions in Pennsylvania. Subject to underwriting guidelines including limits on maximum loan to value Use this calculator to find out the amount you may be able to borrow.

Ad Find Out How Much Equity You Can Release From Your Home. 20 VP Jobs in Mechanicsburg PA UPDATED March 15 2022. Secure a fixed interest rate based on the propertys loan.

Things to Consider. Borrow up to 90 of the appraised value less any liens on the property being mortgaged. Secure a fixed interest rate based on the propertys loan.

Real Estate Equity Loans have a minimum loan amount of 5000. Ad Our service compares over 30 lenders meaning you save time and money. Apply Online Today To Get Started.

Ad Selina are the first in the UK to offer a Home Equity Line Of Credit HELOC - Terms Apply.

How To Move Out And Get Started After You Ve Found Your New Home Set A Date And Taken Care Of The Necessary Steps Li Home Ownership Financial Tips Moving Out

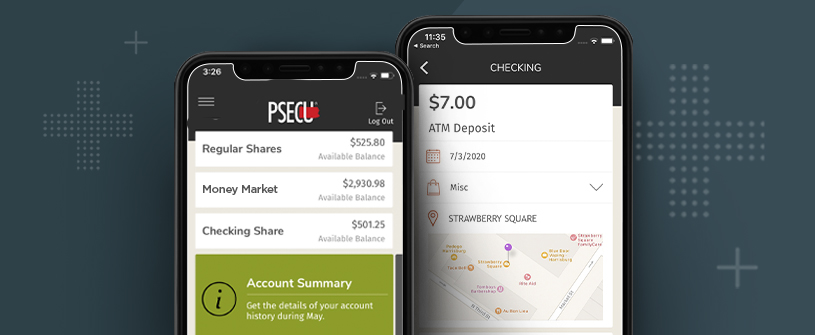

Like All Credit Unions Psecu Is Member Owned We Were Founded By 22 People Who Wanted To Make A Better Life F Credit Union Good Credit Paying Off Credit Cards

Psecu Reviews 2 Reviews Of Psecu Com Sitejabber

Home Equity Line Of Credit Plus Psecu

0 comments

Post a Comment